March 16, 2023 | 6 min read

Maverick's Manual

The No Surprises Act

Table of Contents

Overview

💡 Maverick’s Quick Hit

In addition to banning surprise medical bills, the No Surprises Act (NSA) includes price transparency mandates. Some parts of the NSA are still pending, so stakeholders that understand how the NSA integrates with CMS’s existing price transparency objectives will be well-positioned to proactively influence and engage.

What is the No Surprises Act?

The No Surprises Act (NSA), which became effective on January 1, 2022, is to protect patients from surprise medical bills that can occur when receiving care from out-of-network providers (i.e., providers that do not have a contract with a patient’s health insurance plan for an agreed-upon reimbursement rate). The legislation also mandates that plans and providers enter into a payment dispute resolution process and engage in multiple price transparency activities. Passed in December 2020 as part of the Consolidated Appropriations Act (CAA) of 2021, the NSA included the following provisions:

- Balance Billing Ban

- Notice and Consent Exception

- Independent Dispute Resolution (IDR) process

As of February 2023, there are four primary rules regulating the implementation of the NSA:

- July 2021 interim final rule

- Restricted surprise billing for emergency and some non-emergency care

- October 2021 interim final rule

- Established the Independent Dispute Resolution (IDR) process

- Requires good faith estimates for services provided to uninsured and self-paying patients

- November 2021 interim final rule

- Established payer reporting requirements on prescription drug and health care spending

- August 2022: Finalize requirements in the two previously implemented interim final rules, with modifications to the IDR process

- August 2022 final rule

- Requires group health plans to share about the qualifying payment amount (QPA)

- Created payment determination considerations during Federal IDR process

- Transparency Provisions

- Good Faith Estimate (GFE)

- Patient-Provider Dispute Resolution Process (PPDR)

- Advanced Explanation of Benefits (AEOB)

- Good Faith Estimate (GFE)

- Additional Provisions

- ID Cards

- Prescription Drug Cost Reporting

- Continuity of Care Requirement

- No Gag Clause

- Price-comparison tool

- Online provider directory

What Does it Require?

Balance Billing Requirements

Overview | Providers cannot balance bill patients for out-of-network rates in emergency and some non-emergency settings:

|

What is balance billing? | Surprise billing occurs when a patient unknowingly receives care from a provider who is out of network. This results in a practice known as “balance billing,” where the healthcare provider or facility charges the patient the remainder of what their health plan does not pay. |

Effective date | January 1, 2022 |

Who does this apply to? | The ban applies to all providers at applicable facilities: hospitals, hospital outpatient departments, critical access hospitals, ambulatory surgical centers, and “air ambulance services furnished by nonparticipating providers of air ambulance services.” |

How are bills determined? | For surprise bills, the payment rate is determined by providers and payers, however the patient will not pay more than the in-network rate for that given service. If payers and providers cannot agree on a privately negotiated rate, bills are determined by the independent dispute resolution (IDR) process conducted by a certified entity. |

Enforcement | States have the primary enforcement role (likely through state Attorneys General, Departments of Health, hospital commissions, or medical licensing boards), but the federal government can enforce the NSA either in coordination with states, or in place of states when they are unable or unwilling to. |

| Notice & Consent Exception | Independent Dispute Resolution (IDR) | |

|---|---|---|

Overview | A provider may balance bill if a patient gives prior written consent to waive their rights and be billed more by OON providers.

| If payers and providers cannot agree on a privately negotiated rate, bills are determined by the independent dispute resolution (IDR) process conducted by a certified entity.

|

Additional details | Patients cannot give consent to waive protections under the following circumstances: Emergency services

| Legal disputes have challenged several aspects of the IDR process since the October 2021 interim final rule detailed it.

|

TRANSPARENCY PROVISIONS

| GFE (Providers) | AEOB (Payers)* | |

|---|---|---|

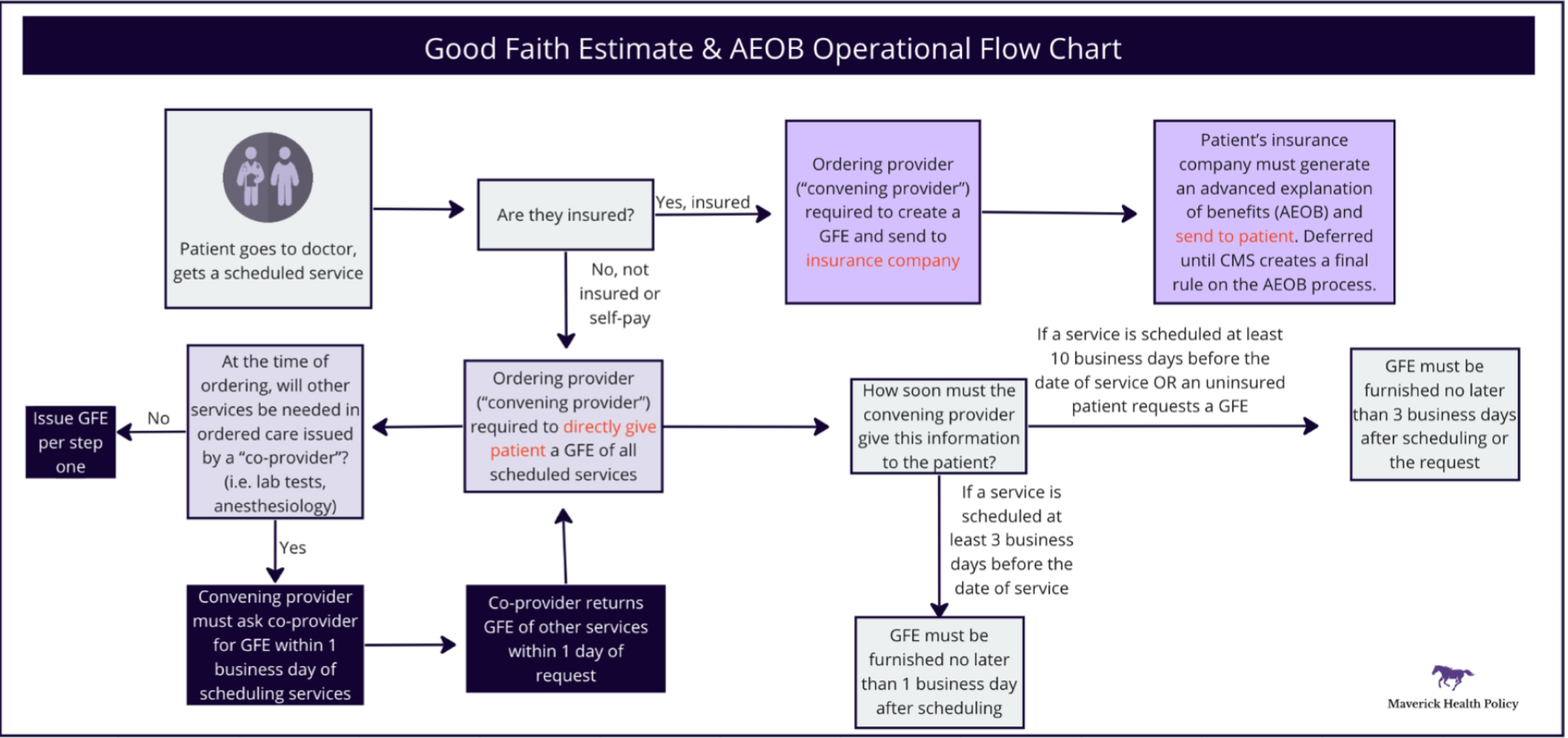

Overview | Providers must provide an itemized good faith estimate (GFE) of expected charges for scheduled services, including any relevant information from other providers ancillary to the scheduled service. | Plans must provide an advanced explanation of benefits (AEOB) with a provider’s GFE, patient expenses, and applicable medication management techniques. |

Who is involved? | Unlike the balance billing protections, the GFE requirements apply to all providers and facilities. For purposes of this requirement, CMS defines two “types” of providers involved in this process:

| The AEOB requirement applies to individual and group plans, but not to federal healthcare programs (Medicare, Medicaid, Medicare Advantage, Indian Health Services, VA Health Care, or TRICARE).

|

Timeline | Convening providers must send a patient a GFE within 1 day of scheduling services, or within 3 days if services are scheduled more than 10 days in advance.

| Health plans must generate and send a patient an AEOB within 1 day of receiving a GFE, or within 3 days if services are scheduled more than 10 days in advance. |

GFE Contents |

| An insurance company must provide patients with an estimate that includes:

|

Who receives a GFE? | The convening provider must generate and directly deliver a GFE to uninsured and self-paying patients.

| Insured patients will receive an AEOB directly from their health plans. |

Effective date | January 1, 2022 for uninsured and self-paying patients* | Statutory deadline: January 1, 2022* |

Penalty | If the bill for the scheduled services exceeds $400 from the estimate, an uninsured or self-paying patient* may initiate a Patient-Provider Dispute Resolution (PPDR) process | No penalty yet* |

Enforcement | HHS has delayed CMS enforcement of the GFE requirement until future rulemaking. . Enforcement was slated to start on Jan. 1, 2023. | No enforcement yet* |

*No official operational details exist for GFEs for insured patients or AEOBs beyond what is written in the NSA law. CMS received feedback that technical infrastructure could not be developed by the January 2022 implementation date, and said it would delay enforcement of the AEOB provisions until they issued a new rule. As of February 2023 CMS has not issued a rule implementing these provisions

ADDITIONAL HEALTH PLAN REQUIREMENTS

| Prescription Drug and Health Care Spending | Price Comparison Tool | |

|---|---|---|

Overview | Plans must report certain information annually to the HHS, DOL, and Department of the Treasury on prescription drug and healthcare spending. | Plans must create an internet-based price comparison tool for enrollees. |

Who is involved? | Group and individual plans | Group and individual plans |

What is required? | Plans must report on:

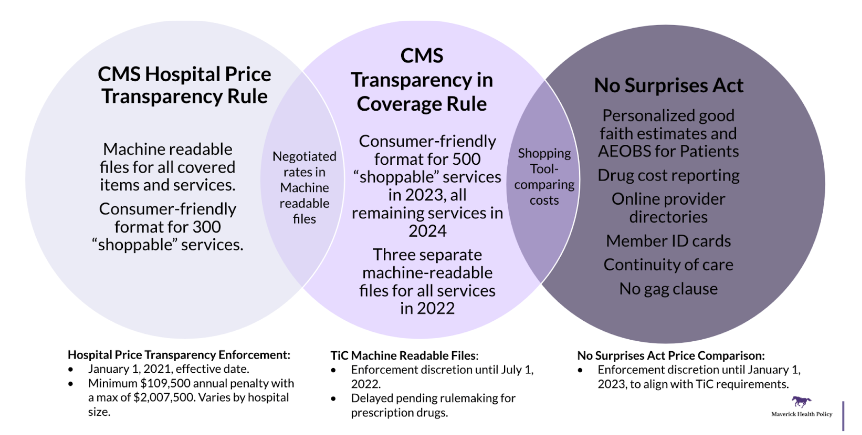

| Plans must provide their members with a consumer-facing price comparison tool with cost-sharing estimates across providers for 500 items and services, accessible online, by phone, or paper copy. This requirement is aligned with the Transparency in Coverage Rule as part of CMS’s plan to make pricing information more accessible.

|

Enforcement | Enforcement for reporting of 2020 and 2021 data began December 27, 2022. Subsequent annual reporting is due by June 1. | Enforcement began January 1, 2023, for the tool that covers 500 items and services. Enforcement for all items and services begins January 1, 2024. However, requirement applicability dates vary based on when the 2023 and 2024 plan or policy years start for each plan or issuer. |

Enforcing agencies by plan type |

|

Prescription Drug Cost Reporting: Plans must report on:

- General plan information: Information on enrollment, premiums, and other identifying plan information

- Annual spending: Total annual spending and healthcare spending categories

- Prescription drug pricing: The 50 prescription drugs that are the most frequently dispensed, most costly, and have had the greatest increase in expenditure over the past year

- Rebates and fees: Prescription drug rebates, fees, and remunerations paid by manufacturers to the plan for each therapeutic class, as well as the 25 drugs with the highest amount of rebates

Price Comparison Tool: Plans must provide their members with a consumer-facing price comparison tool with cost-sharing estimates across providers for 500 items and services, accessible online, by phone, or paper copy. This requirement is aligned with the Transparency in Coverage Rule as part of CMS’s plan to make pricing information more accessible.

- Beginning in 2024, CMS will require price comparison tools to allow individuals to request cost-sharing estimates for specific items and services.

What’s Coming Next?

UPCOMING POLICIES

Rulemaking for the following price transparency mandates in the NSA is currently delayed; updates will be published in the Knowledge Database when issued:

- Good Faith Estimate (GFE) and Advanced Explanation of Benefits (AEOB):

- GFE for Insured: The requirement that providers include any reasonably expected charges provided by co-providers or co-facilities is delayed indefinitely until further rulemaking.

- AEOB: CMS has not yet issued a rule on the AEOB requirement, which would require health plans to explain enrollee out-of-pocket costs for given services, is delayed indefinitely until further rulemaking. This is due to operational challenges stakeholders will face that the agency is currently trying to solve for.

- Online provider directories: Plans must verify and update their provider directories every 90 days, and providers must submit data changes to health plans as part of a quarterly data validation process, or when they terminate a network agreement.

- No Gag Clause: Contracts between plans and providers cannot contain clauses that ban disclosure of certain price or quality information. There will be no further rulemaking; for now, plans must annually attest that they are in compliance.

- Cost-sharing on membership ID cards: Plans must issue physical or electronic ID cards that contain a patient’s deductibles, out-of-pocket (OOP) maximums, and consumer information assistance contact information

- Continuity of care: Plans must notify patients when a provider or facility leaves the plan network while it is providing ongoing care to participants. Patients may opt to have in-network benefits from that provider or facility for up to 90 days.

FAQs

Q1: HOW DOES THE NSA INTERACT WITH OTHER PRICE TRANSPARENCY RULES?

Q2: WHAT SHOULD PAYERS DO?

- Provide an enrollee with their AEOB:

- AEOB is due no later than 1 business day after the payer receives a GFE from the enrollee’s provider

- Undergo IDR process with a provider, if initiated by the provider:

- Under the patient-provider dispute resolution process (PPDR), an uninsured (or self-pay) consumer, or their authorized representative, may initiate the dispute process

- Provide enrollees with a price comparison tool for 500 items and services:

- Must be internet-based, and available by phone or in paper upon request

- Provide prescription drug and healthcare spending information:

- Provide this information annually to the Departments of Labor, Treasury, and Health and Human Services by June 1 of each calendar year

Q3: WHAT SHOULD PROVIDERS DO?

- Provide GFE to self-paying patients:

- Notify patients of their right to obtain GFE

- Provide GFE electronically or on paper as requested by the patient within the applicable deadline

- Undergo Patient Provider Dispute Resolution (PPDR) process:

- For cases in which the charges exceed $400 or more above the GFE, self-paying patients may initiate the PPDR process within 120 days of receiving the disputed bill

- Cease collection efforts immediately and within 10 days of receiving the notice submit all required documentation

- SDR will make a decision within 30 days and losing party will pay SDR fee

- Notify patients of their rights regarding balance billing:

- Public notice online and at provider’s facility

- Provide insured patients with written notice

- Do not balance bill patients above the in-network cost-sharing charge for applicable cases:

- Or obtain their written notice and consent prior to balance billing

- Initiate IDR process with a payer:

- Pay administrative fee, select IDR entity, and receive the decision within 30 days

Q4: WHAT ARE THE NSA’S MOVING PARTS?

- IDR: In February 2023, a federal district court in Texas vacated the portions of the IDR process that the August 2022 final rule established.

- The Court found that the final rule constrained IDR entities’ discretion and gave QPAs more weight than other considerations that the NSA mandated, therefore unfairly skewing the process in favor of payers.

- Certified IDR entities must delay all pending cases until further guidance and recall payment determinations issued after the court ruling in February.

- Although CMS expected IDR to be used infrequently, it is dealing with an influx of IDR cases. The agency intends to raise arbitration fees and hire more personnel to scale up its capacity.

Last Updated on December 11, 2023

Contact Us

Have any questions? We'd love to hear from you.